Recruiting metrics are an essential part of any data-driven hiring strategy. And yet, the number of metrics and data points that recruiters could measure seems endless. Which metrics actually matter, and what data should you focus on to make the most informed hiring decisions?

To ensure your hiring team is leveraging the right data, we’re breaking down the 12 most important recruiting metrics you should be tracking. But first, let’s look at what recruiting metrics are and the role they play in hiring top talent.

What are recruiting metrics?

Recruiting metrics (sometimes called ‘hiring metrics’ or ‘staffing metrics’) are a set of measurements or data points teams use to track, manage, and optimize hiring candidates for an organization.

When used properly, these metrics help your hiring team evaluate your recruiting process, the success of your hiring strategies, and whether you’re hiring the right talent for your company.

You can also tie these metrics to a recruiting matrix to help ensure your hiring process is diverse, inclusive, and fair for all candidates.

Why should you track recruiting metrics?

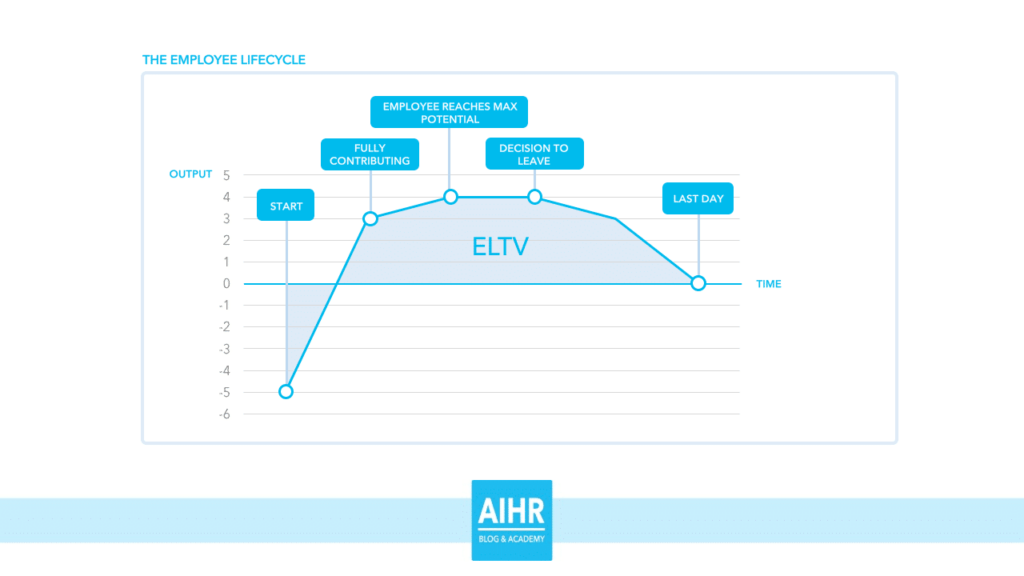

As a recruiter, making the right hiring decisions is crucial. Each hire has to contribute to your organization and drive ROI. Recruiting metrics can help you measure the success of those hiring decisions by looking at the employee lifetime value of each hire you make. Take a look at the diagram below from AIHR—it shows how the lifetime value of an employee changes over the course of their life cycle with an organization.

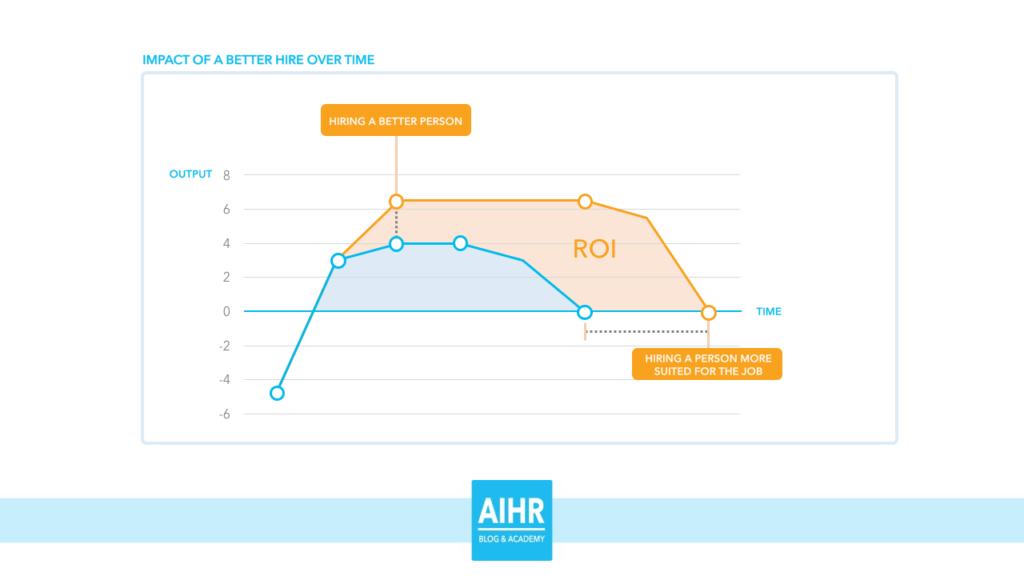

When hiring someone to fill a role, it can take time for the new hire to contribute to the organization and drive a return on investment. But what happens if that hire turns out to be the wrong fit for the role?

As we can see below, hiring someone who is best suited to a role drives more potential for ROI. This is one of the many reasons why sourcing and hiring the right candidates is so crucial—and why tracking recruiting metrics is necessary to help you do that.

How do you set recruiting benchmarks?

Not all recruiting goals are created equal. For example, your hiring team may be more concerned with hiring C-suite candidates while another is recruiting for more junior associates. With this in mind, it’s important to understand what your hiring goals are before you set benchmarks. In a nutshell, recruiting benchmarks are the results you measure all of your recruiting efforts by.

Recruiting benchmarks can range from reducing cost of hire to increasing offer acceptance rates and more. When setting the benchmarks you want to measure against, look at the past performance of your hiring team. You can ask questions like:

- Did we meet our hiring goals compared to other quarters?

- Have we reduced the time and costs associated with hiring?

- Has our attrition rate of new hires increased or decreased?

- How effective are our sourcing channels?

- Have we seen any changes in offer acceptance rates?

That list isn’t exhaustive, but understanding past performance can help you strategize for future improvement. Not only that, but it can give you the insights you need to determine which recruiting metrics you should be focusing on. We mention 12 important recruiting metrics below, but your team may only focus on a few based on hiring goals.

12 of the most important recruiting metrics to track

Whether you’re just starting to measure your recruiting efforts or want to focus on tracking the more critical metrics that will help you optimize your hiring process, our list of 12 metrics is a great jumping-off point.

1. Time to fill

Time to fill refers to the amount of time it takes to source and hire a new candidate. Typically, recruiters measure time to fill based on the number of days between advertising an open role and hiring the right candidate.

Supply and demand often influence this metric—and several factors can lend to this, such as industry demand or how quickly a hiring team operates.

Why does it matter: time to fill helps recruiters and hiring managers better understand how long it can take their team to fill open roles or replace churned employees.

2. Time to hire

Not to be confused with our first metric (time to fill), time to hire shows how quickly a candidate moves through the various stages of hiring. Depending on the role type and your company’s recruiting process, time to hire can be relatively quick or quite long!

Your recruitment funnel heavily influence metrics like. A pretty straightforward recruiting process can reduce time to hire, but roles that require multiple rounds of interviews, panel discussions, test projects, and other steps will drastically increase time to hire.

3. Source of hire

Knowing where your top candidates and applicants are coming from is invaluable, especially in your recruitment marketing. With this metric, you can track which sources and channels are driving the most ROI in attracting job seekers to your open roles.

For example, you can look at your careers page, the job boards or platforms you post open positions to, your social media accounts, and any paid advertising channels you use to determine where candidates come from and which channels are most successful.

4. Diversity of candidates

Diversity recruiting is becoming an essential part of any hiring team’s process for sourcing top talent, and yet, teams may not always track this metric in the same way they do top of funnel ones like time to hire.

To ensure you’re driving diversity in recruiting, look closely at the data around the diversity of your candidate pipeline. You can gather this data and measure this metric by leveraging things like EEO dashboards, candidate surveys, hiring feedback, and more.

5. Attrition rate

Attrition rate is the rate at which your organization loses employees in any given time period. A similar metric is first year attrition.

While attrition isn’t just a recruiting concern, replacing top talent can be costly. There are recruiting and hiring costs to consider, as well as the resources it takes to onboard new employees. This is especially true for first year attrition, which is another metric to consider.

There are several reasons people may leave a company. However, from a recruiting perspective, attrition rate is important. It helps you better understand whether job descriptions and postings accurately communicate expectations and if hiring teams are being transparent during the recruiting process about roles and responsibilities.

6. Quality of hire

This metric refers to the performance of a hire typically within their first year. It also considers the employee’s adjustment time, their acclimation to their teams and culture, and any outcomes of performance reviews.

While measuring quality of hire can be subjective, it’s arguably one of the most important metrics to track. It doesn’t matter how quickly you fill a role, or how much you reduce the cost of hire—poor performance can indicate you have the wrong candidate filling the wrong role.

Given poor hiring can cost organizations thousands, ensuring you’re measuring quality of hire is critical.

7. Applicants per role

A large part of a recruiter’s role is working to bring exposure to open roles within their organization. But how do you gauge whether job seekers are interested? You measure metrics like applicants per role.

With this metric, you can determine the demand for and interest in an open position based on data like the number of applicants per role or hire. Conversely, you may want to look at how many job seekers abandon application processes or choose not to apply to a role once they reach a certain stage of consideration.

8. Cost per hire

Cost per hire is simply the total amount you spent on recruitment annually, divided by the total number of hires you’ve made. The costs associated with recruitment differ in every organization, but it’s wise to benchmark the average costs for various roles in your own company.

To leverage this metric, analyze how much it costs you to hire for each specific role and the funds you spend both internally and externally. For example, internal costs can include employee or recruiter referrals, while external costs may be agency-related, paid advertisements, and more.

Reducing cost per hire is a common objective for many hiring teams, but only when you dig deeper into this data will you have a clearer picture of what hiring truly costs your company.

9. Offer acceptance rate

This metric lets you compare the number of candidates who accepted an offer versus the number of candidates who received an offer. And this insight can reveal a lot for your recruiting team.

Salary and compensation, benefits programs, flex work, and other factors can impact whether candidates accept or decline an offer of employment. A low offer acceptance rate is often indicative of issues that weren’t clarified or resolved during the hiring process.

To prevent this, consider offering more transparency in job descriptions around culture, compensation, and working styles.

10. Number of open positions

You can compare the number of open positions your company has to the total number of positions to determine the success of your hiring strategy—and, more specifically, for certain departments or teams.

If you have a high number of roles still open, for instance, this can be indicative of a lack of demand or interest; meanwhile, a lower number of open positions could indicate high demand, especially during periods of rapid growth or expansion.

This metric is also one to keep an eye on if high volume hiring is a frequent concern for your team, or if you need to hire in bulk and want to track how quickly roles are being filled.

11. Application completion rate

Tracking this metric alongside others like applicants per role can help you understand how streamlined your hiring process truly is.

In some cases, organizations may require candidates to go through an elaborate application process that can take too much time and create frustration for job seekers. A drop in application completion rate can indicate problems with this process and give you insight into where you can streamline it for candidates.

12. Sourcing channel effectiveness

Similar to source of hire, sourcing channel effectiveness can show you which channels are driving the most ROI for your recruiting efforts. With this metric, you measure conversions per channel.

However, before you can do that, you’ll want to create goals for each channel so that you can track which channels are worth the time and investment. This also helps make the conversion rate data more accurate, especially if you’re sharing this with your C-suite or other teams.

Want to build a recruiting process driven by data this like?

Data-driven recruiting is more effective recruiting. But how do you build a foundation for hiring strategies that leverage data at every stage of your recruiting funnel? We answer that question for you through our insightful panel of talent operations pros that you can watch on demand below.

Learn how to build the foundation of a data-driven recruiting process.

Talent Relationship Management, Explained: A Guide for Recruiters

Talent Relationship Management, Explained: A Guide for Recruiters

For the third quarter in a row, Lever has won two Comparably awards!

For the third quarter in a row, Lever has won two Comparably awards!